Railroad retirement calculator

You should contact a Railroad Retirement. 90 of the first AIME bend point plus 32 of the amount in excess of the first bend.

2

This calculator assumes that you make your contribution at the beginning of each year.

. If you are using Internet Explorer you may need to select to Allow Blocked Content to view this calculator. However railroaders paid an additional 49 of their payroll to fund Tier 2 of their Railroad Retirement. These are the identical taxes non-railroaders paid for Social Security.

For example if your earnings totaled 116000 in 2009 and the. About Your Retirement Benefits Estimate. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free.

Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. Your railroad earnings before 1973 are not shown on your Statement but we do use them in calculating your credits and benefit estimates. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free.

Check the Railroad Retirement maximum taxable earnings table and only index the earnings up to the taxable amount. Using the AIME calculate. Ad Annuities help you safely increase wealth avoid running out of money.

Ad Get Personalized Action Items of What Your Financial Future Might Look Like. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. But RR retirement benefits are not taxable in any state thus has its own exclusion line.

Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Our Retirement Estimator generates employee and spouse annuity estimates based on the employees railroad service and. The amount you will contribute to your retirement savings each year. This should reflect the total you.

Ad Track Your Progress Journey Towards Financial Freedom With Jacksons Planning Tools. Railroad Retirement Board William O. If the employee is not retired but has completed 10 years of railroad service or 5 years of railroad service after 1995 the RRB will estimate the divisible and non-divisible.

Annuities provide guaranteed returns by participating in market gains but not the losses. Consequently other retirement exclusions are capped at the 20K24K limit prematurely. Retirement Planner Javascript is required for this calculator.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The Railroad Retirement Board website illustrates prospective benefits under the two systems. Once you enter your age and.

They are calculated based on the highest 35. What are Tier I Retirement Benefits. The Railroad Retirement Board RRB is an independent agency.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. For 2020 you can earn up to 18240 without affecting your railroad retirement benefits. Annuity income results are available on our calculator for ages 55-85.

The formula for the gross tier II amount is 710 of 1 of the employees average monthly railroad earnings up to the tier II taxable maximum earnings base in the 60 months of. If railroad retirement benefits are received amounts from Box 5 on Form RRB-1099. Assuming employees have similar work histories and receive maximum monthly benefits a.

Since this is the first article well start with the basics of RAILROAD RETIREMENT BENEFITS. Tier I railroad retirement benefits are a substitute for social security benefits and are therefore quite similar. For every 2 you earn over that amount your benefits are reduced by 1.

Citizens or resident aliens for the entire. Using our calculator to find out your annuity income. The tool is designed for taxpayers who were US.

66 rows US. Railroad Retirement Board William O. Railroad Retirement Board William O.

Determine the bend points for the first year of eligibility.

Wondering What The Cost Of Senior Living Is Use Our Cost Calculator Chart Infographic Senior Living Infographic

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

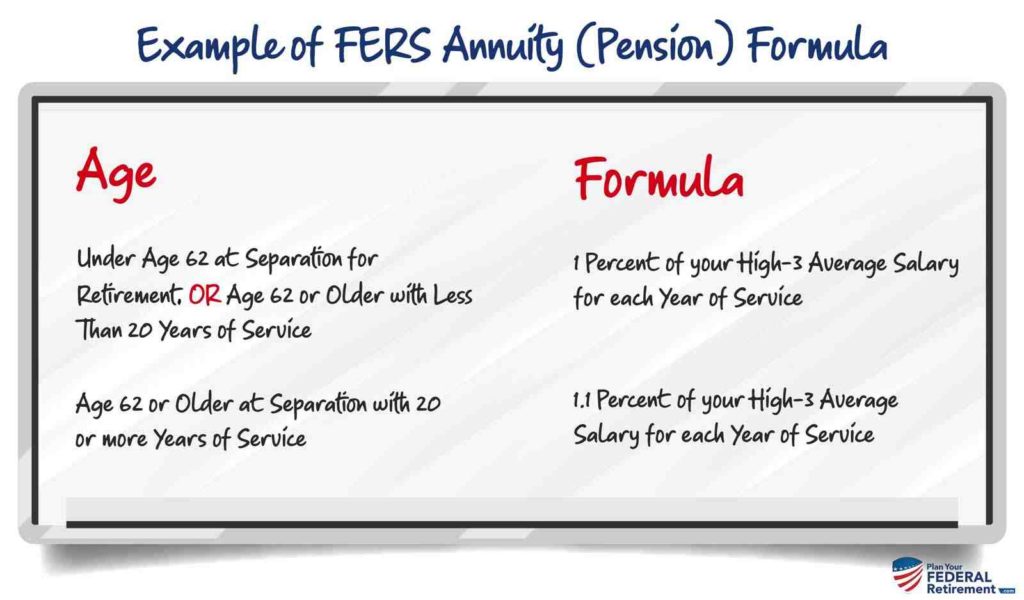

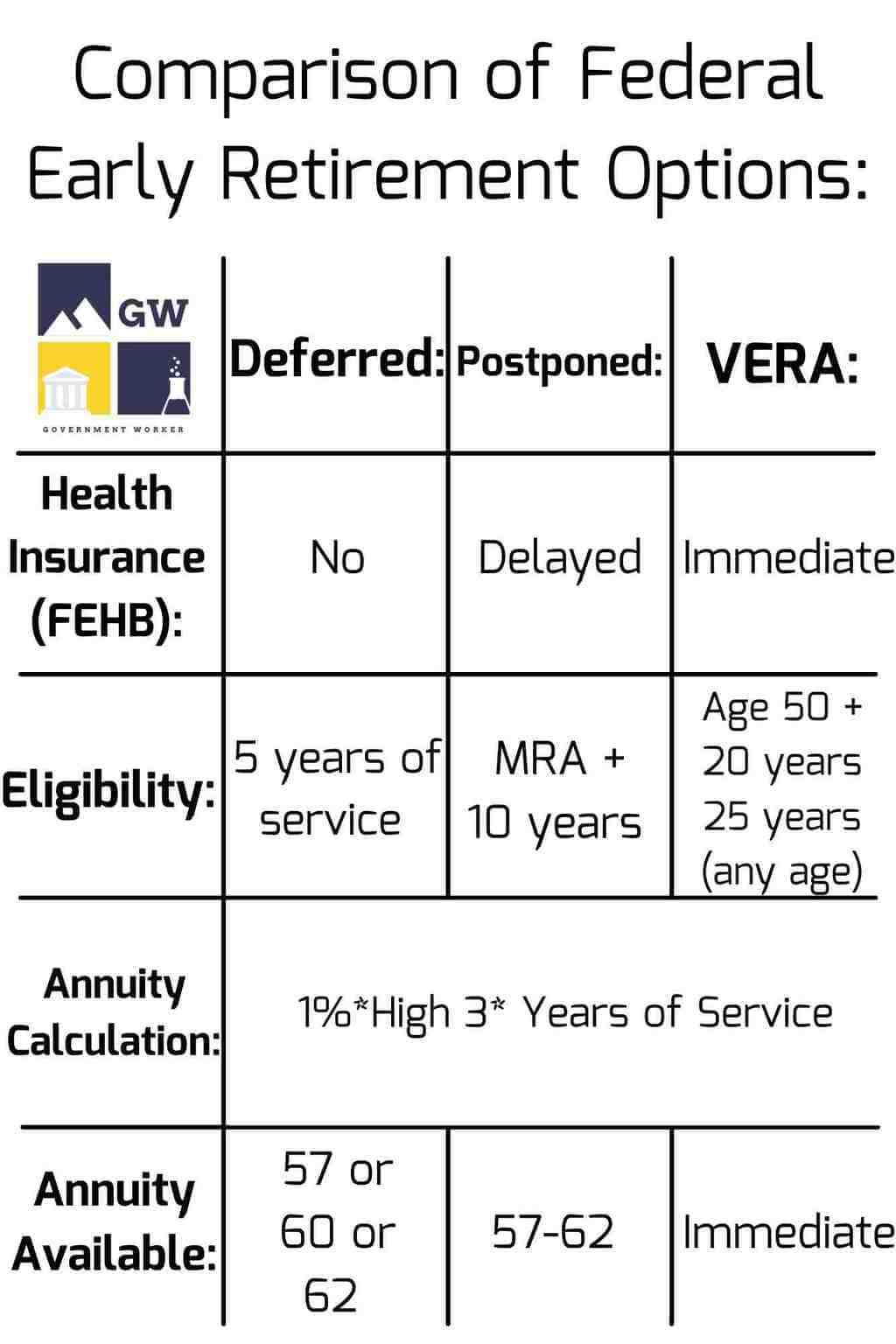

Federal Pension Calculator Government Deal Funding

:max_bytes(150000):strip_icc()/GettyImages-172591496-84cb3a8b534f497cbdc59eb4e930372c.jpg)

Primary Insurance Amount Pia Definition

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Timing Calculator Calculator App Calendar

Retirement Calculator Word Banner In 2022 Calculator Words Retirement Calculator Creative Typography

What Is Bookkeeping And How To Do Bookkeeping In 2022 Forbes Advisor

Railroad Retirement Calculated On Highest Earning Months Or Years Of Service Youtube

Ooh This One Gives Me A Bit Of Creative Spark I Don T Exactly Know What It Is But I Think I Could Modelleisenbahn Anordnung Modellbahn Eisenbahn Modellbau

Narvre How To Calculate For Your Retirement

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Federal Pension Calculator Government Deal Funding

Fact Or Fiction Homebuyer Edition How To Find Out Facts Home Buying

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

When Can I Retire Early Retirement Calculator Fire Calculator Engaging Data Retirement Calculator When Can I Retire Early Retirement

Federal Pension Calculator Government Deal Funding